Gold, Oil, and Uranium: Strategies from a Hedge Fund Insider

Manage episode 438108391 series 3586928

I had dinner with hedge fund manager Harris Kupperman, aka Kuppy, on Sunday (thank you Swen Lorenz for the invitation).

With a 11x net return since 2019, he is one of the world's best-performing fund managers, super-bright and quite inspiring. So today I thought it would be interesting to share his general take on things. What’s his top pick? Wouldn’t you like to know!

I’m also going to look at the long-term ratio between gold and crude oil. This is an important long-term ratio that has hit rare extremes.

Finally, I’m thinking about a tweak to the Dolce Far Niente portfolio—a rare buy—so I’ll tell you about that as well.

Kuppy’s Take

Starting with the equity markets, Kuppy believes we are “nearer the top than the bottom.” While we may not see much action in the short to mid-term, he sees a lot of volatility ahead and the potential for a nasty bear market. With the amount of debt the U.S. holds, the rules of emerging market economies now apply to the US—a point he made several times.

One of his biggest themes is the migration of the 0.1%. People with money are moving to different jurisdictions, where there is more opportunity, less invasive government and lower taxes. (He himself left the U.S. for Puerto Rico and is investing in Swen’s Sark project.)

Kuppy thinks we should “buy the things China is buying.” He likes gold, uranium, and is bearish on the U.S. dollar. He is also concerned about oil.

“It’s behaving strangely,” he says, warning we could be in for “another 2014” (when oil prices collapsed due to an increase in shale oil supply). He even has a theory: offshore drillers have become "so damn efficient" due to recent pressures that we might suddenly see an increase in supply, leading to lower prices.

I share his concerns about oil’s odd behaviour, which brings me to this chart.

Gold is VERY expensive relative to oil

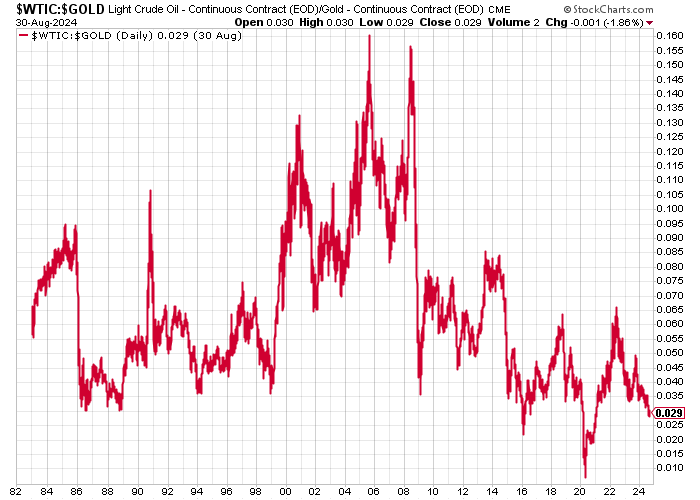

Here’s the ratio between crude oil and gold since 1982.

When oil is stronger than gold, as in 2005-2008 when crude hit $150, the ratio will be high.

When gold is stronger than oil, the ratio will be low—as in 2020 when crude futures briefly went negative during the height of the COVID panic.

Now, we’re at 0.03 ounces of gold per barrel. Only twice since 1982 has oil been cheaper relative to gold.

This chart is telling you to sell gold and buy oil.

(It also looks like quite the inverted head and shoulders pattern is forming.)

Who is right?

This ratio is telling us the opposite of what one of the most brilliant hedge fund managers in the world is saying. What to do?

That’s the beauty of markets. Everyone has their opinion. Some are louder than others. But unlike social media, the market will soon tell you who’s right. That would be the price.

There are various ways this could play out.

Both oil and gold could sell off, with gold dropping more, bringing the ratio back to the long-term average. Alternatively, both could rise, with oil going up by more than gold.

Or, oil could rise while gold falls. And so on.

It’s also possible that the ratio stays low.

My Take on Gold and Oil

It’s hard to find a gold bear these days, which in itself is not a great sign. But I regard my physical gold as a long-term hold, especially given the political clusterfook that is the UK, so I won’t be selling that.

But I am tempted to add to my oil positions.

How to do that?

Next I’ll suggest a simple, low-maintenance method. I’ll also show you some “spicy” small-cap options.

Then we’ll look at adjustments to the Dolce Far Niente portfolio. And finally, we’ll look at Kuppy’s top pick.

18 episoder